- #Turbotax premier 2017 online cost how to

- #Turbotax premier 2017 online cost full

- #Turbotax premier 2017 online cost free

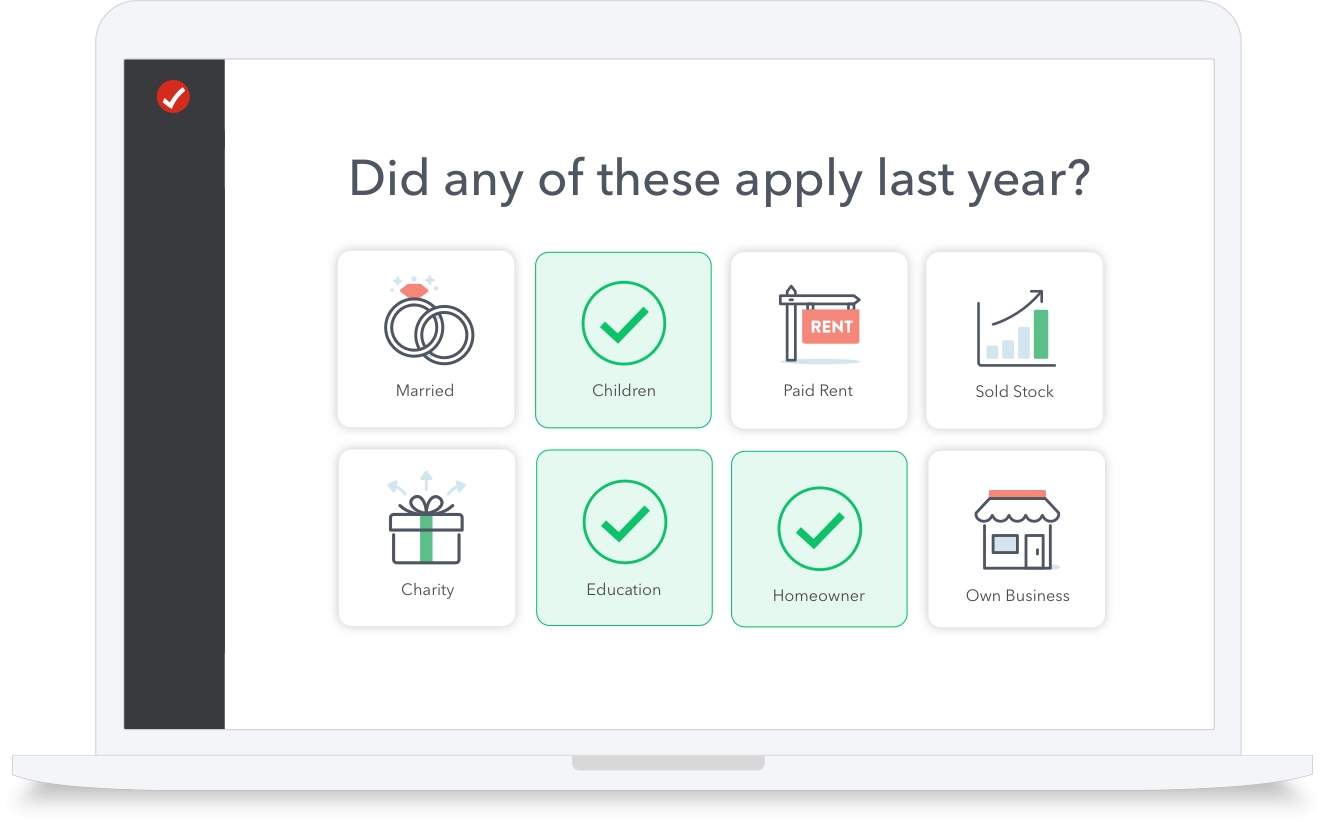

ExplainWhy™ - Understand the "why" behind your tax refund, in a tap.TurboTax is up to date on the latest tax law changes - We've got your back with up-to-date information about Child Tax Credit, Dependent Care Credit, Unemployment Benefits, and Stimulus Payments.TurboTax can help you get your tax refund up to 5 days earlier when you deposit it in a Credit Karma Money™ account(2).We've Got You Covered - We handle all complexities from self-employed to investment taxes and we have real tax experts and trusted technology to get your taxes done right for your unique tax situation.Maximum Refund Guaranteed - On Average $2,766.Simply tap to chat or talk live with tax experts on demand.Get matched with a dedicated tax expert to do your taxes from start to finish, keep you in the loop, and review your taxes with you before filing.

#Turbotax premier 2017 online cost full

TurboTax Live Full Service - Hand your taxes off and let a tax expert do them for you.So you can be 100% confident your return is done right, guaranteed.(1) Get unlimited advice as you do your taxes, and an expert final review. TurboTax Live - Real tax experts review your return.With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

#Turbotax premier 2017 online cost free

$0 Fed, $0 State, $0 to File with Free Edition for simple tax returns only*.Support when you need it - Access TurboTax support to get all your questions answered.Do it yourself, get expert help, or hand it off start to finish – let's get your taxes done right.Over 40 million returns were prepared last year with TurboTax. Don't wait, file today.Īmerica's #1 Free Tax Prep Provider. See all 2020 tax filing information from simple tax returns for $0 with Free Edition*, or get answers from a tax expert - max refund guaranteed.Confirm your tax filing status for 2020 using the Interactive Tax Assistant from the IRS.If you confirm that you filed your 2020 tax return, you won’t need to do anything else. If you haven’t filed your 2020 tax return - or filed a return but didn’t "reconcile" the premium tax credit for all household members - you must do so immediately.You may also get “Letter 0012C” from the IRS.

If you were enrolled in a 2021 Marketplace plan but didn’t file and "reconcile" your 2020 taxes, you’ll get a notice saying you may lose the financial help you’re getting for your 2022 plan. Get a notice telling you to file and "reconcile" 2020 taxes? Include your completed Form 8962 with your 2021 federal tax return. This will affect the amount of your refund or tax due. On Line 26, you’ll find out if you used more or less premium tax credit than you qualify for based on your final 2021 income. Second lowest cost Silver plan (SLCSP) premiumĬomplete all sections of Form 8962.

#Turbotax premier 2017 online cost how to

How to enter information from your 1095-A on Form 8962 What information do I need from my 1095-A? Use the information from your 1095-A form to complete Part II of Form 8962, using the table below as a guide.

Print Form 8962 (PDF, 110 KB) and instructions (PDF, 348 KB). Step-by-step guide to reconciling your premium tax credit See how to be sure the information is correct. If you don't get it, or it's incorrect, contact the Marketplace Call Center. It may be available in your account as soon as mid-January.

(This was paid directly to your health plan so your monthly payment was lower.) The amount of premium tax credit you used in advance during the year. If you had a Marketplace plan and used advance payments of the premium tax credit (APTC) to lower your monthly payment, you’ll have to “reconcile” when you file your federal taxes.

0 kommentar(er)

0 kommentar(er)